Cost perceptions can often be misleading when considering your options for senior living. Many individuals assume that staying in their home is more economical than moving to a senior living community. However, an analysis of current housing costs, maintenance, and healthcare services reveals that independent living, assisted living, or memory care can frequently offer a more affordable lifestyle, especially when social interaction and companionship are factored in. This post will help you evaluate the true costs associated with staying in your house versus transitioning into a senior living community.

Executive Summary

The financial dynamics surrounding the transition from a house to senior living communities may surprise you. While the monthly cost of senior housing often appears higher, the realities of homeownership—including maintenance, property taxes, and care costs—can significantly alter this perception. This analysis explores these aspects and demonstrates how moving to a senior living community can be more economical than remaining in your house.

Compare The Costs of Senior Living vs Staying at Home

How Do The Costs Of Moving Into A Quality Senior Care Community Compare With The Costs Of Staying At Home?

Overview of Cost Comparisons

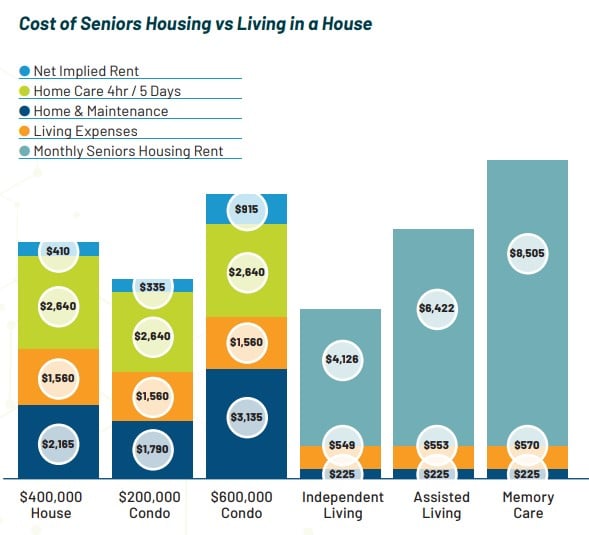

Beside the perceived high costs of senior housing, a detailed breakdown reveals a different story:

| Independent Living | $4,900/month |

| Assisted Living | $7,200/month |

| Memory Care | $9,300/month |

Economic Context and Inflation Impact

One major factor affecting your financial decision is the economic climate, particularly inflation. Since ASHA’s 2017 Brief, housing prices have risen by 22%, and home health costs have surged by approximately 75%. These increases shift the financial advantage towards senior living, making it a more attractive option.

Context: With the escalating costs associated with homeownership, including maintenance, property taxes, and home health care, you may find that expenses can exceed those of moving to a senior living community. Additionally, community living offers not only financial relief but also added benefits such as companionship and social engagement, which contribute positively to overall well-being. Evaluating these factors can significantly aid in making a financially sound decision regarding your living situation.

Cost Analysis of Senior Housing Communities

Now, understanding the financial implications of senior housing communities can significantly influence your decision-making process. With rising costs associated with maintaining a house, many seniors often overlook the true expenses of aging in their own homes. In fact, when you factor in home health care, property taxes, and maintenance, the overall cost of staying in a house can easily surpass the monthly fees of various senior living options.

Monthly Costs for Different Care Settings

Housing costs for senior living vary depending on the level of care you require. As of year-end 2023, the average monthly cost for Independent Living is approximately $4,900, whereas Assisted Living costs around $7,200 and Memory Care is about $9,300. These fees not only include housing but also various services tailored to your specific needs.

Cost Analysis of Senior Housing Communities

Breakdown of Additional Living Expenses

Analysis of your overall costs is vital as you consider moving into a senior housing community. Beyond monthly rent, there are additional living expenses to factor in, such as utilities, meals, and housekeeping. When you total these expenses for independent living in a house, they can often mirror or exceed the cost of senior living.

Communities provide several services that can help you save on these additional living expenses. For instance, many senior housing options include utilities, meals, and housekeeping in their monthly rates, significantly reducing your out-of-pocket costs. With thoughtful planning and an understanding of the comparative costs, you can make an informed decision that supports both your financial and personal well-being.

Costs Associated with Living in a House

It’s vital to understand that residing in a house involves multiple ongoing expenses that might not be immediately apparent. Beyond the mortgage, you face property taxes, insurance, maintenance, utilities, and more, which can quickly add up. For a median-priced home valued at $400,000, these typical monthly expenses can reach about $3,725, making homeownership far more costly than it might initially seem.

Monthly Out-of-Pocket Expenses

Among the various costs of living in a house, monthly out-of-pocket expenses significantly impact your budget. This includes property taxes averaging around $415, maintenance costs approximately $835, and utilities totaling around $425. Over time, these expenses can accumulate, overshadowing the perceived savings from not having a mortgage.

Hidden Costs of Homeownership

With homeownership, many hidden costs often go unnoticed until they become a financial burden. Major repairs like roofing or HVAC system replacements can cost thousands, and unexpected expenses like special assessments can arise from neighborhood associations or property upkeep. These hidden costs can easily escalate the financial demands of homeownership.

This aspect of homeownership underscores the importance of evaluating the overall financial picture. For instance, costs associated with necessary home modifications for aging in place can exceed $10,000. It’s imperative to consider not only the visible expenses but also the potential for unpredictable financial burdens, making senior living communities a more economically viable option.

Affordability Comparison

Many seniors overlook the true costs of staying in their homes compared to moving to senior living communities. Understanding the financial implications can help you make better informed decisions. You can explore valuable insights and data on this topic by View All Publications | ASHA.

Cost Summary Table

| Living Situation | Average Monthly Cost |

|---|---|

| Independent Living | $4,900 |

| Assisted Living | $7,200 |

| Memory Care | $9,300 |

| Living in a $400,000 House | $3,725 |

Affordability of Senior Living Based on Income and Net Worth

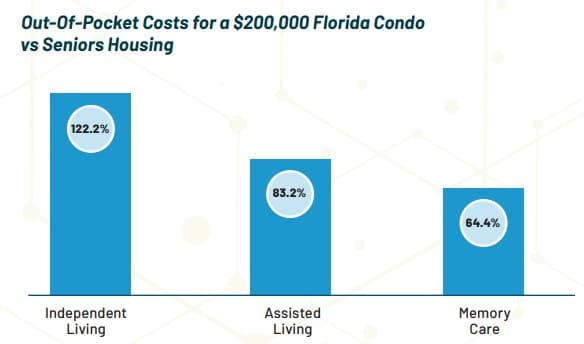

Before considering a transition to senior living, evaluate your income and net worth. According to recent data, affordability for independent living, assisted living, and memory care has improved by 27%, 23%, and 22%, respectively, since 2017. This indicates that many seniors are better positioned financially to make such a move.

Trends in Housing Prices and Cost of Living

Living expenses, including home maintenance, property taxes, and other costs, have risen significantly. Housing prices have increased by 22%, while home health care costs soared by around 75%. Sequentially, these rising costs underscore the financial benefits of choosing senior living options.

At the same time, the average monthly costs for independent living, assisted living, and memory care stand at $4,900, $7,200, and $9,300, respectively. The rapid increase in housing and care costs highlights a trend where the financial burden of staying in your home could outweigh the benefits of moving to a structured community. Exploring these options could lead to better financial and lifestyle choices for you and your loved ones.

Trends in Housing Prices and Cost of Living

Social and Emotional Benefits of Senior Living

Once again, many prospective residents often overlook the significant social and emotional benefits of moving to a senior living community. These communities provide not only a safe environment but also abundant opportunities for social engagement and connection. You’ll find activities and amenities designed to foster friendships, combat loneliness, and enhance your overall quality of life, making the transition more emotionally fulfilling.

Importance of Companionship

Around 43% of seniors report feelings of loneliness, which can negatively impact both physical and mental health. In a senior living community, you are surrounded by peers who share similar interests and experiences, providing a supportive network that mitigates the risks associated with isolation.

Mental Well-being in Community Settings

Against the backdrop of rising healthcare costs and the pressures of maintaining a home, the mental well-being benefits of a senior living community become clear. These communities offer structured social interactions and engaging activities, which can significantly enhance your mood and cognitive function.

For instance, studies have shown that seniors in community settings experience lower rates of depression compared to those living alone. The environment encourages participation in communal events and activities, which not only help to maintain mental acuity but also promote a sense of belonging. Engaging with others regularly can enrich your life and provide emotional support, ultimately leading to a healthier, more satisfying lifestyle.

Market Dynamics Affecting Senior Living Costs

Unlike many may think, the economic landscape is shifting in favor of senior living communities. Rising costs in housing, food, and healthcare have heightened the need for individuals to reassess their living situations. For a comprehensive breakdown, refer to the Cost Comparisons Often Favor Senior Living (2024) | ASHA, where you’ll see how financial considerations increasingly align with the benefits offered by senior housing.

Changes in Consumer Behavior

Alongside economic shifts, you may notice that more seniors are reassessing their living arrangements. Increased awareness of the hidden costs associated with home ownership—such as maintenance, property taxes, and health care—drives families to explore senior living options that offer comprehensive care and social interaction. This awareness is changing the narrative and influencing decision-making.

Future Economic Considerations

Against the backdrop of potential interest rate reductions, housing prices are expected to rise, further impacting the financial landscape for seniors. This scenario means more seniors will be looking to sell their homes at beneficial prices, reinforcing the affordability of senior living communities.

Plus, as you evaluate your options, consider the potential appreciation of your home’s value and how it affects your net worth. The analysis indicates that affordability for independent living, assisted living, and memory care has improved by 27%, 23%, and 22% respectively since 2017. These economic dynamics strongly suggest that transitioning to a senior living setting could not only be financially viable but also offer a better quality of life with crucial support and community engagement.

Find Where You Belong

Dive into the vibrant life our Westmont communities have to offer.

Final Words

The analysis presented here highlights that the costs of staying in your house often outweigh the expenses associated with the cost of senior living. By considering property taxes, maintenance, and healthcare, you may find that moving to a community can be a more economical choice while also providing important companionship and support. To explore more about the financial implications of your options, check out this Cost Comparison: Aging At Home Vs. Senior Community In Florida.