Living With Purpose: How Our Residents Give Back and Strengthen Their Communities

Living With Purpose: How Our Residents Give Back and Strengthen Their Communities

At the heart of our Mission is a simple but powerful promise: to provide inspiring life experiences that enable our residents and their families to lead full and enriching lives. While many Senior Living communities focus solely on care, amenities, and hospitality, we believe that truly enriching lives means creating opportunities for connection, contribution, and purpose.

This philosophy shines through in our Values, especially the guiding principle of Involvement, which reminds us that participation is the foundation of making a meaningful difference in the community. Time and again, our residents show us that no matter one’s age, the impact of giving back is profound for both the community and for the individual.

Giving Back Through Generosity

Across our Communities, residents actively engage in initiatives that support the greater good. These are not passive activities, but rather they are moments of genuine contribution, leadership, and camaraderie. A few examples include:

Annual Toy Drives

Residents and team members come together each holiday season to collect toys for local children and families. For many of our Residents, this tradition is a meaningful reminder of the joy and hope they’ve shared across generations. Their generosity fills not only donation bins, but hearts.

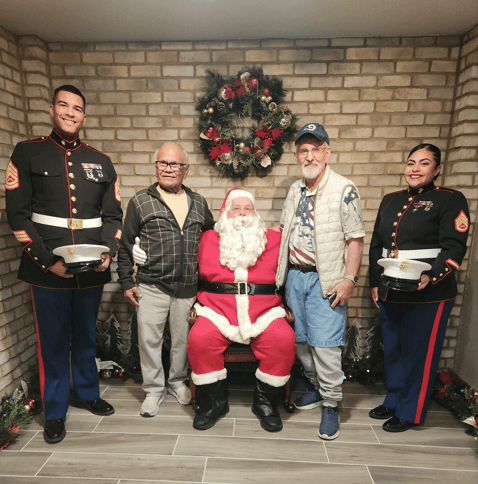

Our Westmont of Riverside Community annually partners with Marine Corps Reserve Toys for Tots and is an official Toys for Tots drop-off location for the larger Community. Residents, families, team members, and neighbors are encouraged to donate new, unwrapped toys. These toys are collected and sorted by local campaign coordinators, which are often Marine Reservists, Marine Corps League members, or local community volunteers before being distributed to families identified through trusted social service agencies and nonprofit partners.

One of the highlights of this partnership is the opportunity for our Residents to meet the Marines who make the program possible. Local Marines personally visit Westmont of Riverside to collect the donated toys, offering moments of connection, gratitude, and pride.

Lifestyle Director Todd Mills shared how meaningful this experience has been for the Community:

“Our Residents light up when the Marines arrive. It’s more than just dropping off toys—it’s a shared moment of respect, service, and community spirit. Many of our Residents have lifelong ties to the military, so being able to contribute to Toys for Tots makes them feel connected to something bigger.”

— Todd Mills, Lifestyle Director, Westmont of Riverside

Local Food Drives

Our communities proudly partner with local food pantries to help address food insecurity. Residents sort, package, and contribute non-perishable goods, knowing their efforts directly support neighbors in need. This involvement builds a sense of shared responsibility and reinforces that purpose has no age limit.

Charity Crafting & Service Projects

From knitting scarves and beanies for shelters to assembling hygiene kits for outreach programs, residents regularly transform their hobbies into acts of service. These projects nurture creativity, connection, and a sense of accomplishment that comes from helping others.

Our Westmont of Cypress Community is home to a remarkable resident-led group called Women of Westmont, who meet monthly to organize and lead a variety of service projects throughout the year. Their efforts reflect the true spirit of involvement and purpose by giving back in meaningful ways.

Some of their recent initiatives include gathering essential items for local shelters, creating handmade scarves and dolls for women’s shelters, and coordinating additional acts of kindness that support vulnerable community members.

Women of Westmont Mission Statement: “To inspire and enrich all lives through social interaction, service projects, educational programs, and mental and physical health activities to become the best versions of ourselves.”

This is purposeful living in action, aligned with our Vision to exceed expectations while inspiring hearts and minds.

A Community That Gives Together, Grows Together

When residents step forward to support their local communities, something remarkable happens: they rediscover the sense of identity, agency, and belonging that comes from helping others. And when we support these efforts, we honor our Mission by creating spaces where meaningful experiences flourish.

Involvement isn’t just a value we talk about, but it’s a way of life in our Communities.